The mining industry is inherently capital-intensive, requiring substantial financial investments in infrastructure, equipment, and technology. Mining projects involve enormous costs for exploration, development, and ongoing operation.

The sheer magnitude of capital investment exposes mining companies to financial risk. Particularly during periods of volatile commodity prices and economic downturns.

Mining operations occur in environments characterized by complex geological structures, remote locations, and potential environmental sensitivities.

As a result, the industry carries inherent risks that include geological uncertainty, environmental challenges as well as logistical hurdles, geopolitical risks, and variances in regulatory constraints and practices.

Mitigating Market Volatility in Every Mining Phase

Mining is also subject to cyclical market trends. Commodity prices can fluctuate significantly, impacting the profitability and sustainability of mining operations.

These market dynamics add an additional layer of risk to the industry. Risk management plays a crucial role in addressing these challenges, ensuring the sustainability and profitability of mining ventures.

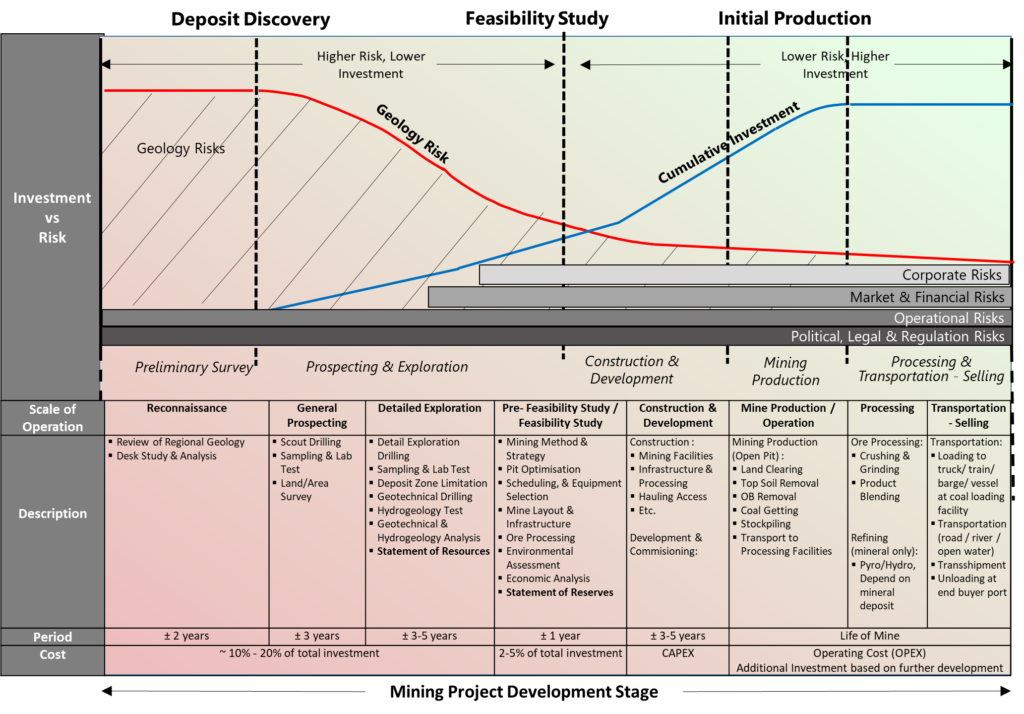

Figure 1 – Risk vs Investment during mining project development stage

As a capital intensive industry with set of typical high-risk characteristics, the risk management in mining is important to be developed in every stages of mining development.

Started from preliminary survey, exploration, feasibility study, construction & development, operation & production, processing-refining, transportation & shipment, environmental management and post-mine closures.

There are several risks associated during mining project development stage.

Preliminary Survey, Exploration, and Feasibility Study

Mining begins with a preliminary survey, exploration, and feasibility study.

Preliminary survey is the initial stage where the potential of a mineral deposit is assessed, followed by exploration drilling and sampling to determine the extent and quality of the deposit.

After all of the geological & exploration data is collected, the analysis during feasibility study evaluates the economic viability of the project.

Risks associated here includes:

- Geological & Exploration Risk Assessment: Geological risk is a significant concern as the quality, quantity, and location of mineral deposits can vary significantly. Exploration risks include drilling failures and inadequate data.

- Techno-Economic Analysis Risks: Risks involve pit design optimization, underestimating capital and operating costs, leading to financial challenges later.

- Regulatory and Permitting Risks: The preliminary stages are also fraught with regulatory and permitting risks, as obtaining the necessary approvals and complying with environmental regulations can be challenging.

- Environmental Considerations: Environmental risks must be considered from the outset, including potential impacts on local ecosystems and communities.

Mine Development & Operation-Production

The risks at this mine development stage revolve around safety, project delays, and budget overruns.

Daily mining activities during operation-production introduce workplace health and safety risks. Along with production challenges, equipment failures, and ore quality variations.

- Production and Engineering Risks: The machinery and processes used in mining operations can be complex and prone to technical failures, requiring vigilance and maintenance.

- Technology and Equipment-Related Risks: Rapid technological advancements in the mining industry introduce risks associated with equipment obsolescence and the need for continuous adaptation.

- Workplace Health and Safety Risks: The construction and operational phases involve a range of hazards for workers, necessitating rigorous safety protocols and training.

- Environmental Management and Mitigation Measures: Mining operations impact the environment, leading to ecological risks, regulatory issues, and community concerns. Robust environmental management strategies are essential to address the environmental risks associated with mining.

- Social & Community Risks: Local community relations, social license to operate.

- Reputational Risk: Damage to a company’s image due to environmental or social issues

- Political & Regulatory Risk: Changes in government policies, permitting challenges, and regulatory compliance challenges

Processing-Refining and Transportation-Shipment

- Environmental and Compliance Obligations Risk: environmental risks arise from waste management and chemical usage during processing; therefore, regulatory compliance is critical.

- Supply Chain and Transportation Risks: Ensuring a seamless flow of resources from the mine to consumers involves supply chain and transportation risks. Risks associated with product transportation & shipment include accidents during transportation and the potential for supply chain disruptions.

Product Marketing & Sales Financial Management

- Commodity Market and Price Risks: Fluctuations in commodity prices have a direct impact on mining profitability, making market and price risks a central concern.

- Market and Sales Risks: Market dynamics, changing consumer preferences, and competitive forces are integral components of sales risks.

- Financial and Cost-Related Risks: Sound financial management is critical to mitigate financial and cost-related risks. These include budget overruns, inflation, and exchange rate fluctuations.

Post-Mine Closures

Risks in this stage relate to long-term environmental and financial obligations, including site rehabilitation

- Closure and Post-Closure Risks: After mining operations cease, post-closure risks pertain to ongoing maintenance and rehabilitation. Mining companies/operators must diligently follow closure plans to minimize these risks.

- Regulatory and Compliance Obligations: Post-mine closure often comes with ongoing regulatory obligations and compliance responsibilities.

Baca juga artikel kami yang lain terkait peraturan dalam pembuatan RKAB: Penyusunan RKAB